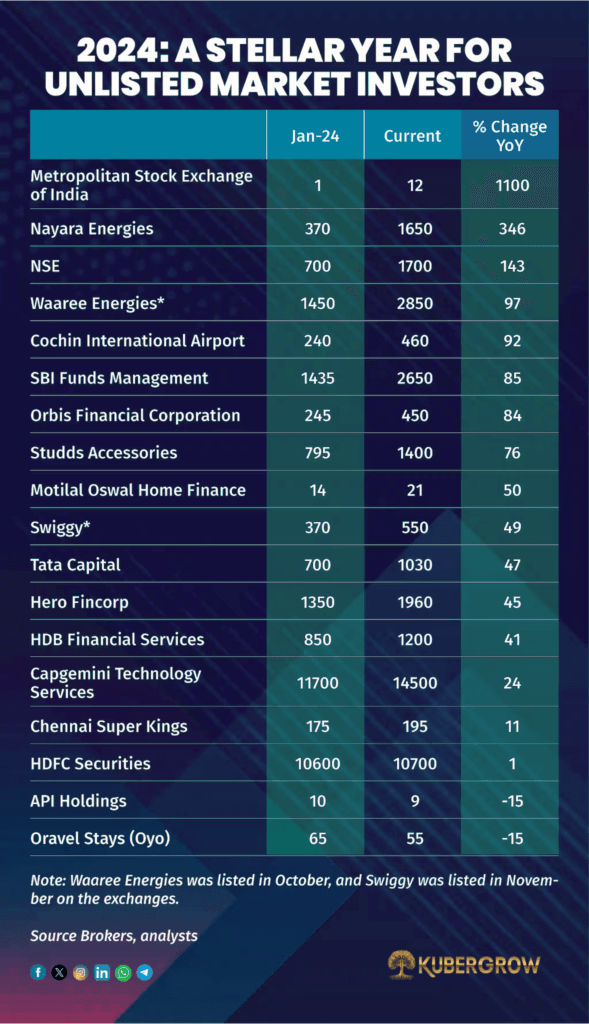

The year 2024 proved to be a landmark period for unlisted stocks, with several companies delivering significant returns for investors. Standout performers included Nayara Energy, which surged by an astonishing 346%, the National Stock Exchange (143%), Cochin International Airport (92%), and Studds Accessories (76%). Tata Capital, Motilal Oswal Home Finance, and others also showed robust gains.

Driving this surge was heightened demand and trading activity as investors sought higher returns compared to listed equities. The vibrant IPO market played a pivotal role, with high-profile listings like Waaree Energies and Swiggy further fueling interest in unlisted shares. Waaree Energies, for instance, saw its unlisted share price rise from ₹1,450 in January to ₹2,850 post-IPO in October.

Overall, unlisted stocks delivered a stellar 27.68% return in 2024, outpacing the Nifty 50’s 11.64%. Monthly trading volumes in the unlisted market grew exponentially, reaching $300 million by year-end, up from $50-$60 million in 2023.

While the market offers exceptional profit potential, experts caution about high valuation risks and the unregulated nature of unlisted trading. Analysts recommend conducting thorough due diligence and working with trusted brokers to navigate this dynamic market effectively.

With continued investor enthusiasm and promising IPO prospects, the unlisted market remains a lucrative space, though vigilance and careful valuation analysis are essential for success.