Studds Accessories Ltd, India’s largest helmet manufacturer, has finally received the green light from SEBI to launch its Initial Public Offering. After a long wait of seven years, the Haryana-based company is ready to ride into the public market with full throttle. The company had earlier filed its DRHP back in 2018 to raise ₹98 crore, but the plan hit the brakes. Now, with its updated DRHP filed in March 2025 and SEBI’s final approval granted, the IPO journey is officially on track.

This time, Studds is offering a pure Offer for Sale (OFS) of 77.86 lakh equity shares. Each share comes with a face value of ₹5, and the proceeds from the issue will go directly to the existing shareholders, including promoters, who are offloading their stake. In short, the company itself won’t be pocketing any fresh funds from this listing. Once live, the shares will be listed on both the National Stock Exchange and the Bombay Stock Exchange.

IIFL Capital Services Ltd and ICICI Securities Ltd have been appointed as the lead managers for the issue. With these financial heavyweights on board, Studds seems to be taking a well-planned route to market entry.

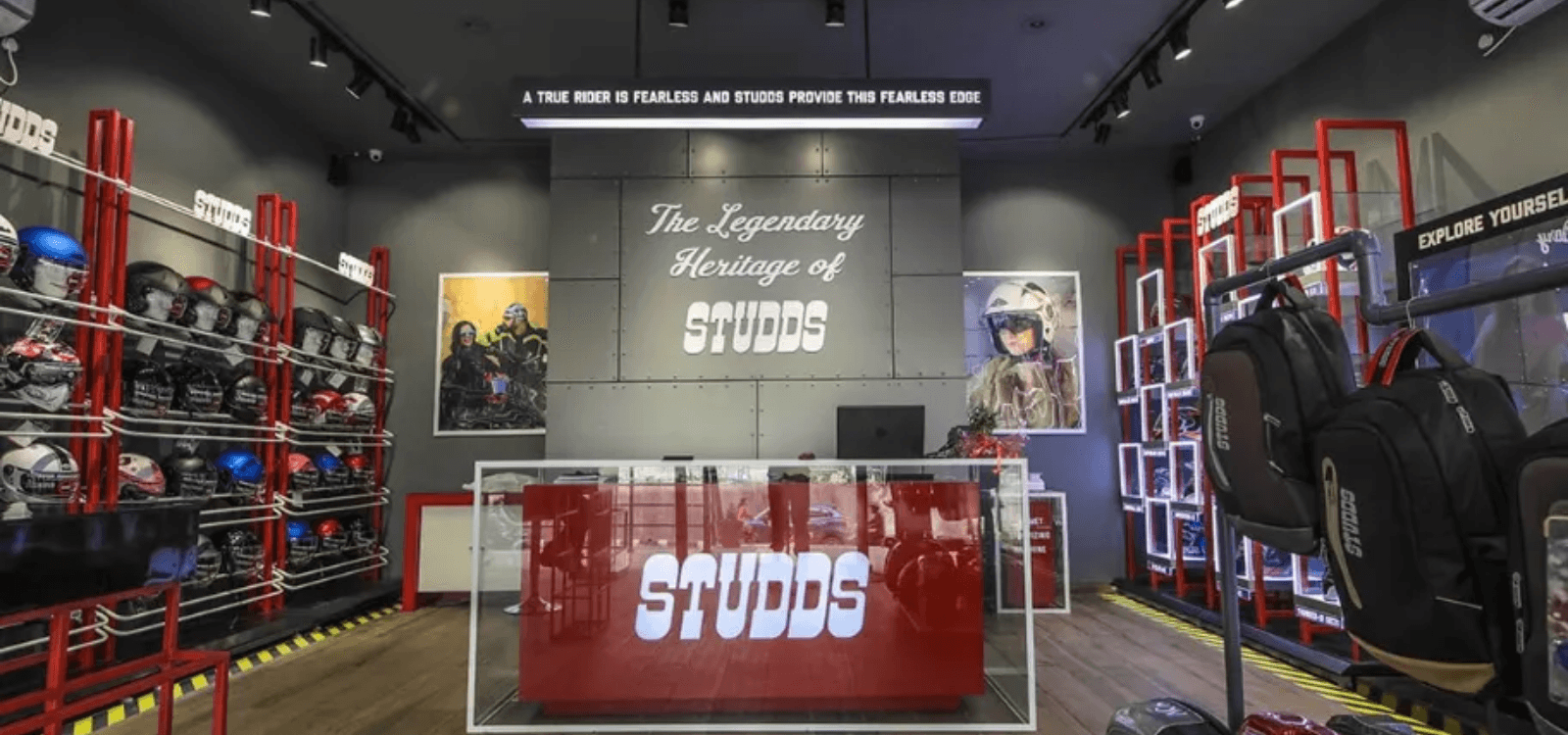

Founded in 1983 and headquartered in Faridabad, Studds has carved out a name for itself in the two-wheeler helmet space. It commands the largest market share by volume in India and operates under two major brands. The flagship ‘Studds’ caters to the mass segment, while ‘SMK’ targets premium consumers. But the company doesn’t stop at helmets. It also manufactures and sells riding accessories such as jackets, gloves, eyewear, and rainwear, making it a one-stop shop for biking gear.

Studds runs four advanced manufacturing facilities in Haryana, collectively churning out up to 9 million helmets annually. Its footprint isn’t limited to India either. With exports to over 70 countries including the US, Latin America, and Europe, the company supplies to international brands like Daytona and O’Neal. On the home front, Studds relies on a robust dealer network that spans over 340 partners across the country.

Financially, the company is on a healthy track. In FY24, it reported revenue of ₹529 crore, a modest but steady 6 percent jump over the previous year. What’s more impressive is the sharp 73 percent rise in net profit, which climbed to ₹57 crore. This growth was driven by better margins, improved operations, and stronger sales of higher-end products.

As Studds prepares for its IPO, the market will be watching closely. Will this listing rev up the company’s public image and investor interest? The track record and numbers look promising, and with the right helmet on, Studds seems ready to take the curves and straightaways of the stock market with confidence.